Welcome to the official website of Shenzhen Dankai Technology Co., Ltd.!

Sitemap | contact us | Online message | CN

Telephone:

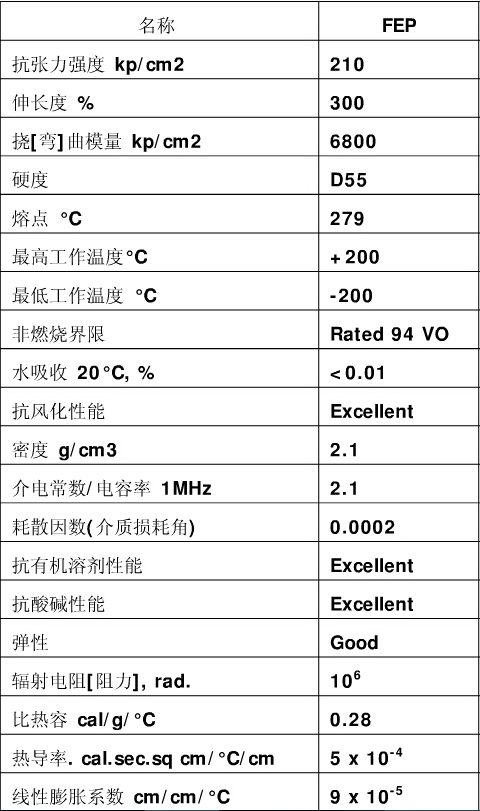

+8615158121839Hot key words:Polyperfluoroethylene propylene(FEP/F46) PTFE Teflon series PFA PVDF

News

Telephone:

+8615158121839Information details

The "point price" model effectively improves the efficiency of the plastics industry

- Categories:Industry news

- Author:PFA tube lady

- Origin:PFA tube lady

- Time of issue:2015-06-27 17:44

- Views:

The "point price" model effectively improves the efficiency of the plastics industry

- Categories:Industry news

- Author:PFA tube lady

- Origin:PFA tube lady

- Time of issue:2015-06-27 17:44

- Views:

The three types of linear low-density polyethylene (LLDPE), polyvinyl chloride (PVC) and polypropylene (PP) currently listed on the plastics chemical futures market are large in scale and high in commodity rates, giving them a good foundation for futures trading. With the enrichment of plastic futures varieties and the formation of the industrial hedging chain, the market function has been brought into play. It has also enabled the spot entity companies’ attitudes towards the futures market to experience wait-and-see, learn, and participate in the formation of their own business models and trading strategies. The maturity of futures tools has witnessed the mature development of the Dalian plastics futures market and also reflects the effective connection between industry and finance.

Recently, at the "2015 China Plastics Industry Conference" held in Chengdu, Sichuan, Wang Xiaofeng, general manager of the research department of Yuanda Petrochemical Co., Ltd., said that the good function of the plastic futures market has effectively improved the efficiency of the industry, and the use of futures by enterprises has become increasingly diverse.

Wang Xiaofeng said that Broad’s use of futures tools has gone through a process from passive participation to active participation. After LLDPE futures were listed on the Dalian Commodity Exchange in 2007, companies mainly used futures for hedging. After 2009, with the enrichment of futures varieties, companies began to actively participate in the futures market, adopting multiple models such as futures arbitrage, basis trading and cross-variety trading, and companies using futures to enter the "business model" stage. After 2014, companies began to use futures tools to innovate business models and help them expand their living space through OTC and external inventory management models.

The understanding of futures tools and the enrichment of business models have also changed with the development and improvement of the plastic futures market. They have mutually promoted the effective function of futures products. Enterprises have also formed their own business models for using futures, and have effectively used them to achieve better results. Good results. "The use of futures by enterprises is shifting from profit-making to the service industry." Wang Xiaofeng said. Among them, benefiting from the effective convergence of futures and current prices, the combined operation mode of futures and current has become one of the core models used by enterprises. The reporter learned that companies use better varieties of futures and current linkages to study and judge market trends. For example, on the first working day of the LL1501 contract that ended the "November" holiday last year, the spot stabilized and the downstream replenishment transaction was good, but the futures price showed a large drop, which dissipated the enthusiasm for downstream purchases, and the spot began to fall with the futures price. The price drove the spot trend. Later, after the LL1501 contract price stabilized for two days from December 11 to 12, the downstream replenishment was expected to be strong. The purchase of the spot market increased on the 15th, pushing up the spot price, and the futures price followed the spot price increase, reflecting the spot market’s preference for futures. Driven by.

In addition to the traditional model, the futures "point price" model has also begun to affect the plastics market order model. According to Wang Xiaofeng, the price of raw crude oil fell sharply in 2014, but the price of corporate orders fell only slightly, the profits of downstream products were large, and the futures prices were discounted compared to spot prices. At the same time, downstream factories basically stopped using recycled materials and changed to buy new materials instead of recycled materials. The demand of enterprises was further enlarged, and inventory was very low during the same period, and downstream buyers had the motivation to rebuild inventory. Based on this background, Yuanda Petrochemical began to conduct price operations on the PP1501 contract to help the factory lock down downstream orders in advance. On the one hand, the use of the "point price" model is that the enterprise acts as a link, which facilitates downstream delivery and promotes the effective convergence of futures and currents. On the other hand, the "point price" model has improved downstream pricing capabilities and increased the buyer’s enthusiasm for participating in the futures market. The shift from the "spot price-based product order" model to the "future price-based order model" will amplify the relative weakness in the past. The right to speak of downstream buyer companies to further enhance market efficiency.

More news

Landline: 0755-29979617

Cell phone: 15818669373

Add WeChat, free sample

Follow the corporate public account

Shenzhen Dankai Technology Co., Ltd.

Address: Area B, 4th Floor, Building 1, North Yongfa Science and Technology Park, Yanchuan North, Chaoyang Road, Songgang Town, Bao'an District, Shenzhen

Tel: 0755-29979617 23127719 23127819

Fax: 86-0755-29979492

Follow us

Page copyright©1998-2024 Shenzhen Dan Kai Technology Co., Ltd. Guangdong 粤ICP备12071381号